Fitsum MEHARI (吗龙)Department of International Relations, Tsinghua University. Currently pursuing a MA in International Relations, specializing in Chinese Politics and Foreign Policy.

China-Africa: Building Roads of Prosperity

At the turn of the century despite six of the fastest growing economies being African, only two – Ethiopia and Rwanda – were not dependent on oil and other commodity prices to achieve this growth.[1] Ethiopia is a notable example as it has experienced significant economic growth in the past decade. This is largely attributed to its infrastructure development and industrialization led growth strategy the country has adopted from experiences of East Asian countries, notably China.[2] However, levels of African regional and global trade remain significantly low. A corollary to this is the continent’s massive infrastructure deficit.

The infrastructure constraints facing African countries are numerous and difficult to overcome. Lack of financing, inadequate planning, construction and operating capacities are just a few of the challenges. Through its flagship program, African Continental Free Trade Area (AfCFTA), the African Union (AU) aims to increase trade and mobility within Africa.[3] Interestingly, China has become a major partner in these efforts. By providing loans and FDI within the frame works of the Forum on China-Africa Cooperation (FOCAC), and more recently the Belt and Road Initiative (BRI), China has become the largest single financier and the top infrastructure projects developer in Africa. Is the Chinese engagement economically beneficial for Africa, and what should Africans do to ensure the relationship is mutually beneficial as well as economically sustainable?

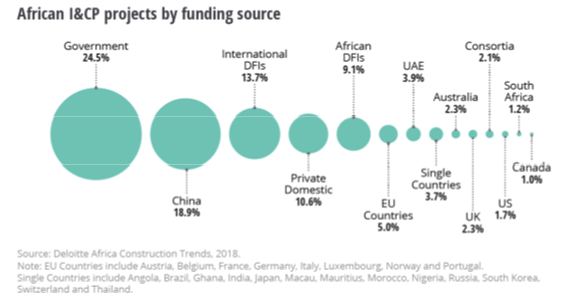

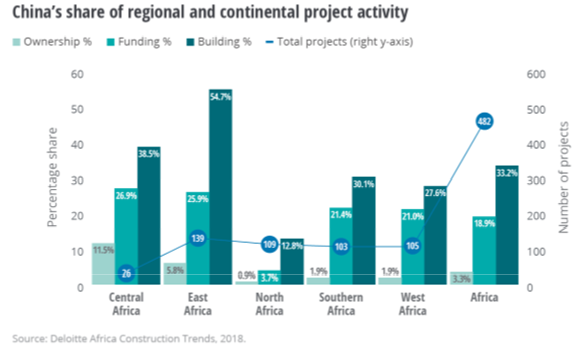

For significant economic integration to take place in Africa, a substantial stock of economic infrastructure like transport, energy and ICT is needed. China’s engagement in the sector coincides with and is likely to galvanize decades-long African efforts for comprehensive continental integration. The African Development Bank estimates the continent’s infrastructure construction and maintenance gap ranges from US$130bn – US$170 per year, of which an average of less than half is being met.[4] Infrastructure investment averaged 23% and 20% of GDP between 2010 - 2017 for North and Sub Saharan Africa (SSA), respectively. These investments, valued at US$471 bn, were largely financed by African governments (24.5%).[5] That said, China remains the largest single financier at 18.9% and a builder of 33.2% of these projects.

[Figures 1 and 2]

It is a fact that infrastructure related sovereign debt is high among African countries. This has raised questions on the sustainability of new and existing loans, especially with the increasing momentum of the BRI.[6] While this is a legitimate concern, Africans can gain economic opportunities from expansion of infrastructure and maintain a sustainable development. Ethiopia is a case in point. From 2007/08 to 2017/18 Ethiopia maintained an average of 9.9% GDP growth rate, almost double the regional average.[7] It also invested an average of 30% of its GDP on infrastructure development.[8] According to recent data from the China Africa Research Initiative, the country has borrowed around US$ 13 bn from China since the year 2000.[9] The lion share of these 52 loans went to infrastructure development: US$ 11.2 bn went to transport, energy and communications while US$ 2.1bn was allocated to industry.

Many analysts agree that Ethiopia is a good example of how African countries can harness Chinese engagement for economic development.[10] Sharing this sentiment, last winter, I led a group of graduate students from the Department of International Affairs of Tsinghua University and the School of Advanced International Studies at John’s Hopkins University to conduct a field research in Ethiopian. We examined the country’s recent economic progress and the growing activities of Chinese firms in Ethiopia’s industrial sector.[11] Specifically, we looked at stakeholder (i.e., government, firms and workers) strategies pertaining to one Chinese as well as three Ethiopian owned Special Economic Zones. Our assessment indicates that the establishment of these zones has provided gainful employment for the local work force and increased the country's export revenues. However, we also learned of several problems in stakeholder strategies, which are causing inefficiencies.

As an old Chinese proverb highlights, “if you want to prosper, first build roads”. China’s engagement is making significant contributions to Africa’s integration by way of expanding economic infrastructure. The BRI is expected to spur intra-African trade and FDI estimated to reach 7.4%, with most of the gains going towards SSA.[12] In further expanding China-Africa comprehensive relations, the last FOCAC forum underscored the need for targeted and mutually beneficial strategies and policy coordination. One of the proposals from the forum called-for the formulation of a China-Africa Infrastructure Cooperation Plan. This plan aims to articulate and implement cooperation strategies to increase the funding, design, construction, and operation of infrastructure projects – bolstering economic development in Africa. It will be a collaborative initiative between China and the AU. By providing funds and expertise, China’s engagement is alleviating Africa’s large infrastructure deficit. Furthermore, the onus rests on African policymakers’ agency, like those exhibited in Ethiopia, in formulating adequate policies and strategies to harness sustainable economic gains from Chinese engagement in infrastructure development.

Figure 1 and 2

Endnotes

[1] Noman A, Stiglitz JE. Industrial Policy and Economic Transformation in Africa [Internet]. New York: Columbia University Press; 2015.

[2] Oqubay A. “Industrial Policy and Late Industrialization in Ethiopia”, Working Paper Series N° 303, African Development Bank, Abidjan, Côte d’Ivoire. (2018).

[3] World Bank. The African Continental Free Trade Area: Economic and Distributional Effects. Washington, DC: World Bank. doi:10.1596/978-1-4648-1559-1. License: Creative Commons Attribution CC BY 3.0 IGO. https://openknowledge.worldbank.org/bitstream/handle/10986/34139/9781464815591.pdf

[4] African Development Bank, “African Economic Outlook 2018”, 2018,

www.afdb.org/en/knowledge/publications/african-economicoutlook/

[5] Deloitte Africa, “Africa Construction Trends”, 2018, www2.deloitte.com/za/en/pages/energy-and-resources/articles/africa-construction-trends-report.html.

[6] Dollar, David. “Understanding China's Belt and Road Infrastructure Projects in Africa.” (2019). Brookings. https://www.brookings.edu/research/understanding-chinas-belt-and-road-infrastructure-projects-in-africa/

[7] World Bank. Ethiopia Economic Update. “The Inescapable Manufacturing Service Nexus: Exploring the potential of distribution services”. World Bank 2018, http://documents1.worldbank.org/curated/en/811791526447120021/pdf/126255-WP-PUBLIC-DIGITAL Ethiopia-Economic-Update-The-Inescapable-Manufacturing-Services-Nexus.pdf

[8] World Bank, “World Development Indicators Data Catalogue”, 2019,

https://databank.worldbank.org/data/reports.aspx?source=2&series=NE.GDI.FTOT.ZS.

[9] Brautigam, Deborah, Jyhjong Hwang, Jordan Link, and Kevin Acker (2020) "Chinese Loans to Africa Database," Washington, DC: China Africa Research Initiative, Johns Hopkins University School of Advanced International Studies. https://chinaafricaloandata.org/

[10] China-Africa and an Economic Transformation. Eds. Oqubay, Arkebe, and Justin Yifu Lin.: Oxford University Press, June 20, 2019. Oxford

[11] China-Ethiopia Economic Relations. Department of International Relations, Tsinghua University. 2020. WeChat. https://mp.weixin.qq.com/s/ni18AVzlmU-7DukPnnDiwQ

[12]“China’s Belt and Road Makes Inroads in Africa” The Diplomat, 2018,

https://thediplomat.com/2018/07/chinas-belt-and-road-makes-inroads-in-africa/

The article originated from Student Association of Belt and Road Initiative.